Sign up here |

|

|---|

Advertising at the Edge of 2026

The New Normal: Advertising at the Edge of 2026

Here we are—on the eve of a trillion-dollar ad economy—and it feels less like a victory lap than a takeover notice.

The line between “digital” and “everything else” doesn’t exist anymore. Digital is the economy, and it runs on machine learning, not Mad Men instincts.

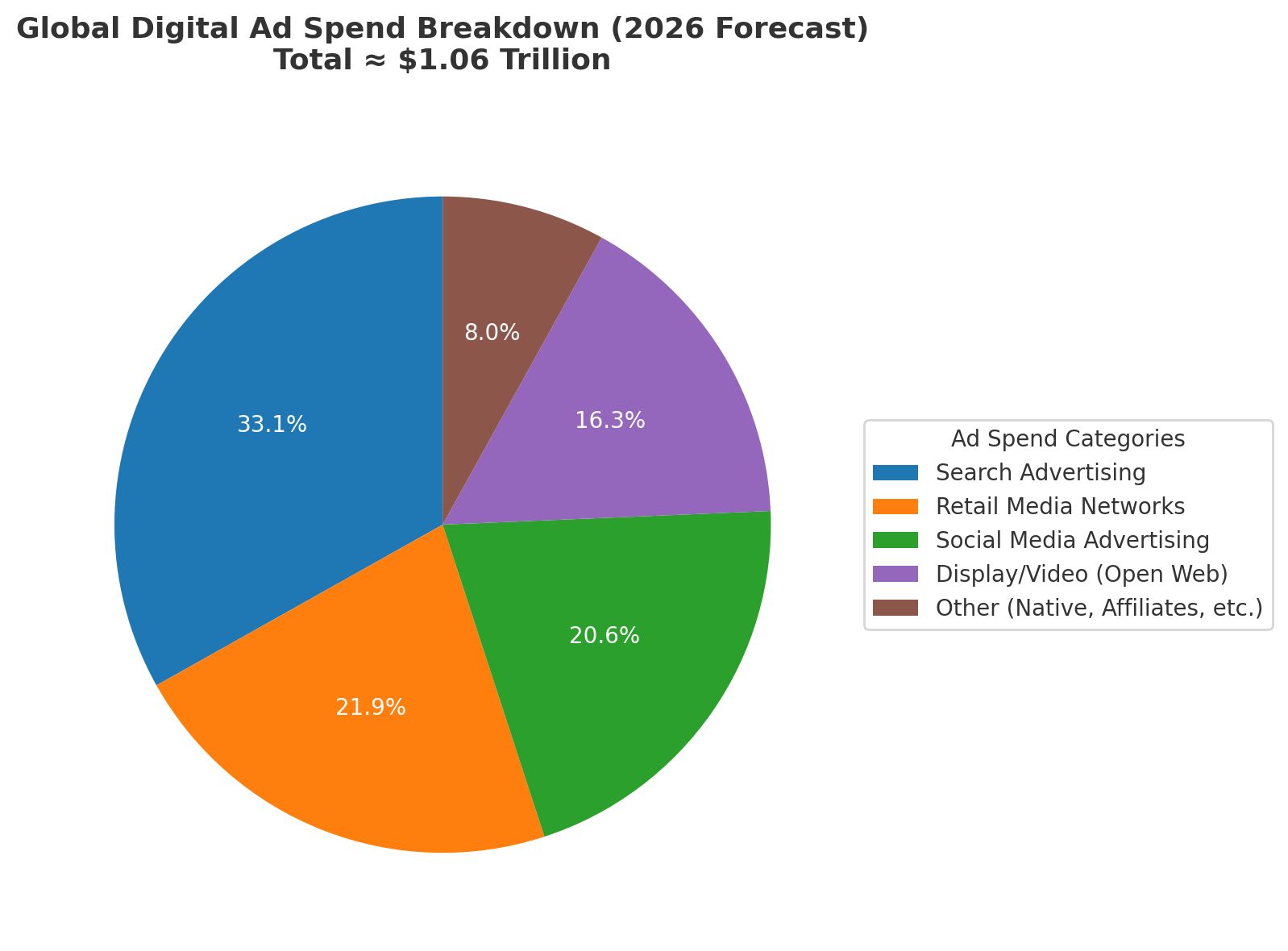

Global ad spending will hit $1 trillion next year, with over three-quarters of that filtered through digital systems that track, predict, and optimize our behavior.

This isn’t evolution; it’s annexation.

There’s no longer a “digital team.” There’s just a marketing department desperately trying to stay relevant inside an ecosystem owned by five companies—Meta, Google, Amazon, Microsoft, and ByteDance—that together control 65% of the U.S. ad market, up from 22% just ten years ago. That’s not market dominance. That’s an oligarchy wrapped in an SDK.

Meta’s Reels is now a $50 billion ad machine, quietly outpacing television as the world’s new watercooler. Google and YouTube will cross $200 billion in digital revenue—the first ad business to break that ceiling. Amazon’s ad arm, once a side hustle for product listings, now generates more profit than AWS in some quarters. Microsoft, the least flashy of the bunch, sells the compute power that makes everyone else’s AI possible. And ByteDance? TikTok is the algorithmic subconscious of the planet. If you want to see culture now, you scroll it.

Let’s stop pretending this is healthy competition. It’s not. It’s five data empires running global persuasion markets at GPU speed.

The Great Compression

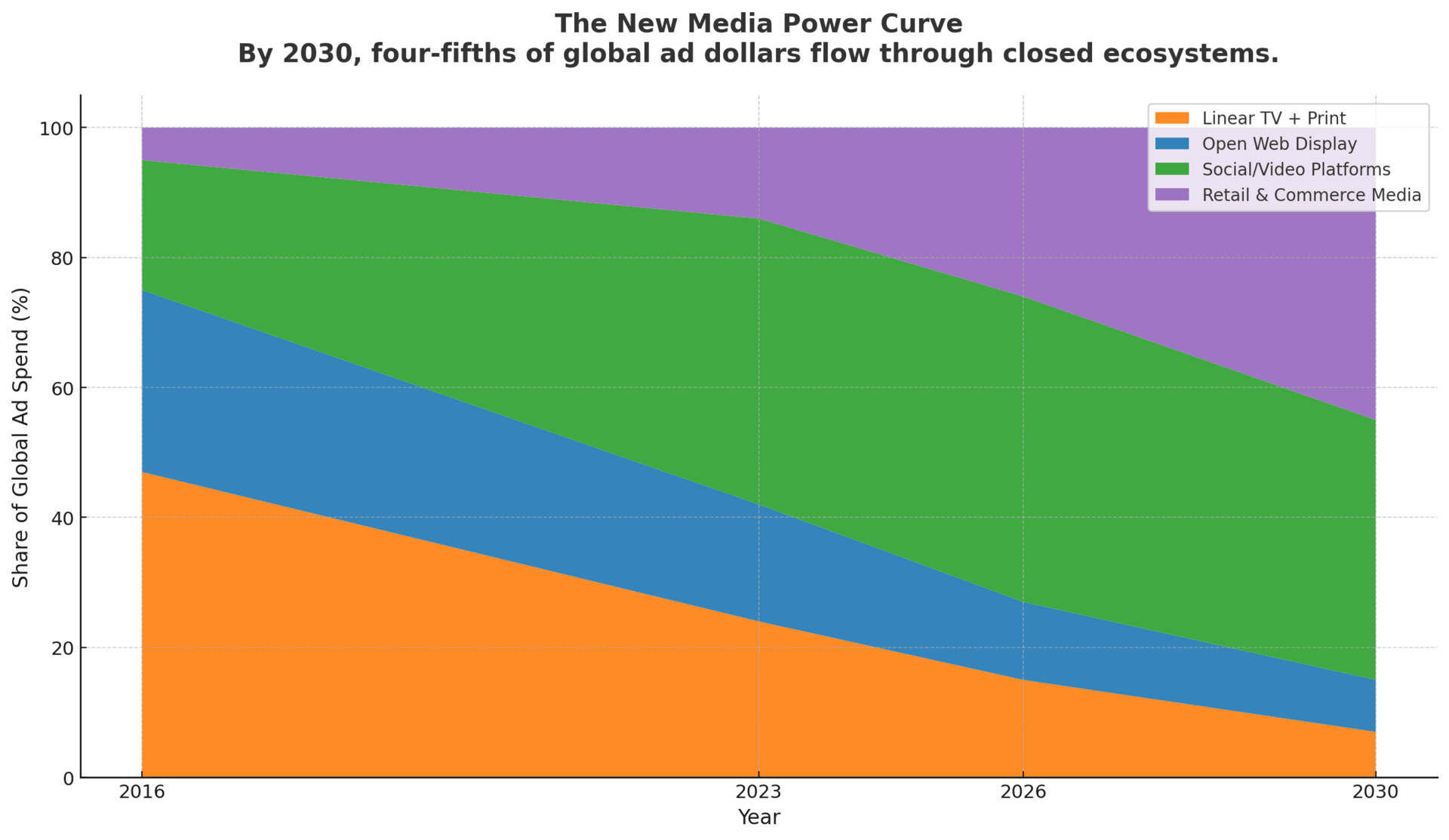

Everyone’s been talking about the death of the cookie, but that was just the appetizer. The real story is the death of independence. Third-party data is radioactive, privacy laws are multiplying, and “open web advertising” has become an exercise in nostalgia.

Brands that spent a decade outsourcing identity to someone else’s cookie jar are now back where they started—begging for first-party data like it’s oxygen.

Retail media networks saw the opportunity and pounced. They have consent. They have purchase data. They have loyalty programs that double as surveillance systems. Retail media will take 22% of all digital ad spend—roughly $231 billion—next year, which means Walmart, Target, and Kroger are now ad-tech companies that also sell groceries.

The real joke? They’re the privacy-friendly option.

The Collapse of Attention

Meanwhile, television is bleeding out in broad daylight. Linear ad revenue is down about 9%, and that’s before another election cycle wrecks what’s left of CPM sanity. Ad-supported streaming, on the other hand, has turned that decline into a feeding frenzy—reclaiming roughly half the lost dollars and redefining what “premium video” even means.

Nine of every ten new ad dollars now go to digital-only platforms. The last one goes to someone still buying “awareness.” That person probably still uses a fax machine.

Connected TV isn’t “the next big thing.” It’s retail media with better lighting. Every impression is just another SKU in a marketplace of moments, priced and traded by machines that don’t care what show you’re watching. If you think of television as storytelling, you’re a romantic. If you think of it as an auction interface, you’re right.

The ROI Religion

Creativity used to be the pitch. Now it’s a rounding error. Marketers no longer ask, “What’s the idea?” They ask, “What’s the lift?” Every campaign must prove incrementality. Every creative decision must justify its existence to a dashboard.

As one CMO said to me recently—half amused, half terrified—“We’re not competing with other brands anymore. We’re competing with our own algorithms.”

This is the new hierarchy: platforms at the top, agencies somewhere below the waterline, and humans somewhere near the footnotes. The ground has shifted from creative persuasion to computational advantage, and most of the industry still hasn’t realized it’s playing a different game.

The Hard Truth

Advertising didn’t die—it metastasized. The creative class has been replaced by a class of prompt engineers, data scientists, and performance analysts who speak fluent ROI. AI hasn’t destroyed the industry; it’s just made it brutally efficient.

So if you’re planning 2026 like it’s 2023, you’re already irrelevant.

The new currency is attention, the new asset is data, and the new creative brief reads like a line of Python.

Welcome to the trillion-dollar machine.

The Rabbi of ROAS

The Big Picture: When Every Screen Becomes a Walled Garden

Platform Domination & the Hollowing Out of Choice

The ad industry used to talk about diversity of supply like it was a virtue — thousands of publishers, multiple DSPs, and the comforting illusion that programmatic was a free market. That fiction is over. The reality heading into 2026 is that five companies don’t just dominate ad spend — they own the devices, the operating systems, and the data pipes that determine who gets seen, who gets paid, and who gets erased.

Concentration isn’t new, but the scale is unprecedented. The same companies shaping global advertising — Meta, Google, Amazon, Microsoft, and ByteDance — are now embedding themselves into the hardware that delivers it. Control of the screen is now control of the auction. And control of the auction is, effectively, control of the entire narrative of modern media.

The Device Supply Chain: The Real Ad Network

According to recent CTV market-share data, the fragmentation everyone bragged about has quietly become a handful of supernodes that determine how the open web actually functions.

Roku leads North America with a 36% share and dominates 44% of all connected-TV traffic in Latin America. It’s no longer a platform; it’s a sovereign ad exchange disguised as a streaming interface. When most programmatic auctions in CTV run through your hardware, you don’t compete — you legislate.

Samsung, with 21% share across EMEA, has turned its smart TVs into fully integrated commerce portals. It’s no longer about watching; it’s about transacting. The company effectively owns “TV-as-checkout,” merging shoppable content, CTV data, and its own ad network into a single economic loop.

Xiaomi is the quiet empire-builder. With 18% of the APAC market, it’s proven that affordability still scales faster than innovation. Its inexpensive devices have created vast addressable audiences — a treasure trove of ad inventory that undercuts Western pricing models while flooding the programmatic supply graph with measurable impressions.

And then there’s Apple — late to the ad-tech party but already rearranging the furniture. Apple TV’s 30% quarterly growth in Canada and an eye-watering 69% spike in the UK make it clear that Cupertino’s ecosystem strategy is working. Apple’s hardware has become ad real estate with a privacy halo — the ultimate premium inventory for brands desperate to reach affluent audiences without the ethical hangover of surveillance advertising.

Together, these players aren’t competing for market share; they’re redrawing the laws of participation.

The End of Open

What we still call the “open marketplace” is increasingly an elaborate illusion — a façade of choice stretched across a handful of private networks. Supply paths that appear transparent are routed through proprietary systems with their own measurement frameworks, their own attribution logic, and their own versions of “truth.”

Programmatic trading was supposed to create equality between buyers and sellers. Instead, it has codified inequality. DSPs can bid, but they can’t see everything. SSPs can sell, but they can’t touch the data that defines value. Advertisers can target, but only within the walls they’re assigned to.

As one CTV executive put it bluntly, “There is no open market anymore — there’s just a parade of walls pretending to be windows.”

Each platform dictates its own targeting rules, its own creative formats, even its own pacing algorithms. Apple restricts audience granularity under the banner of privacy. Roku requires native integrations for analytics. Samsung prefers commerce-linked buys that prioritize its own demand partners. It’s an auction model in name only — a marketplace where the house wins every hand.

The Warning Sign: The Disappearing Middle

The middle of adtech—the “independent” layer once meant to keep the system fair—is vanishing. The open exchanges, verification networks, and mid-tier SSPs that once promised neutrality have become collateral damage in a market now controlled by platforms that own the screen, the data, and the attribution. Programmatic didn’t democratize advertising; it centralized it. What was supposed to be an open bazaar has turned into a handful of walled gardens trading inventory among themselves.

And here’s the uncomfortable part: buyers prefer it this way. Closed ecosystems are faster, cleaner, and more predictable. CFOs love the efficiency; CMOs love the dashboards; boards love the word “certainty.” Every direct deal that cuts out an intermediary feels like progress—until you realize it’s tightening the noose around competition itself. The convenience of consolidation is intoxicating, and it’s killing the very independence the industry once claimed to protect.

For publishers and smaller tech firms, the squeeze is existential. Verification layers are being defunded, open exchanges are losing volume, and “neutral” data platforms can’t keep up with the compliance and compute costs of competing with Amazon or Google. What remains is a duopoly of control: those who own first-party data and device-level access, and those who rent it. Everyone else is negotiating survival.

But not everyone’s surrendering. Viant is one of the few companies still trying to rebuild a real middle class for adtech—an open ecosystem that doesn’t depend on a single walled garden’s rules. Instead of selling complexity or chasing retail media gold rushes, Viant is doubling down on transparency: first-party identity, verifiable measurement, and privacy-safe infrastructure that gives brands genuine visibility into where their money goes. In a world allergic to accountability, that’s almost revolutionary.

The bigger story is what comes next (in a few weeks, actually) The disappearance of the middle isn’t inevitable—it’s a choice being made every time someone prioritizes convenience over competition. The question for the industry is simple: will anyone still fight for an open marketplace when the walls finally close? Viant intends to. And starting soon, we’ll show exactly how only in ADOTAT+ in two weeks

The Strategic Reality Check

This is the landscape you inherit: fewer platforms, tighter controls, and nearly opaque transparency. Winning in it requires unlearning a decade of media buying orthodoxy.

If the old model was “follow the data,” the new one is “understand the device.”

Your audience strategy is now a hardware strategy. Your measurement plan is now an OS negotiation.

The companies that win will be the ones fluent in the politics of platform ecosystems — those who can translate their data across walls instead of pretending the walls don’t exist. Everyone else will still be talking about “open markets” while they quietly disappear.

Welcome to advertising’s age of invisible walls. The view looks free — until you try to leave.

🔥 WHAT YOU’RE MISSING IN ADOTAT+ (AND WHY YOU SHOULD UPGRADE TODAY)

You’ve read the free version. Cute. But you’re missing the stories the industry whispers, not the ones it posts on LinkedIn.

ADOTAT+ is where adtech’s secrets get autopsied — who’s winning, who’s dying, and who’s pretending “integration” is a strategy.

Here’s What You Missed While Scrolling the Free Feed:

The MadTech Manifesto — adtech didn’t merge with martech; it colonized it. AI isn’t a tool — it’s your new boss.

The DSP Collapse Files — five platforms already for sale, one being quietly dismantled.

The Roku Paradox — what happens when you don’t own the screen in a world where screens own the market.

Retail Media’s Revenge — the $400B ecosystem that replaced cookies and made “brand independence” a myth.

Automation Ate Strategy — 90% of campaign decisions are now made by AI. The humans just sign the invoices.

Because by the time the “thought leaders” summarize this in three bullet points, you’ll already have the playbook — names, numbers, and what collapses next.

👁 ADOTAT+ — where the industry confesses before the press release drops.

👉 [Upgrade Now] — before the algorithm decides you’re legacy media.

Subscribe to ADOTAT+ to read the rest.

Unlock the full ADOTAT+ experience—access exclusive content, hand-picked daily stats, expert insights, and private interviews that break it all down. This isn’t just a newsletter; it’s your edge in staying ahead.

Upgrade