Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Sign up here |

|

|---|

When “Access” Stopped Meaning Power

The CTV Moment It Hasn’t Fully Claimed Yet.

For a meaningful and genuinely impressive stretch of time, Viant managed a rare trick in adtech: it positioned itself as an insurgent without sounding like it had just discovered fire or wandered into the industry five minutes ago with a manifesto and a PowerPoint.

There was no chest-thumping, no breathless promise to reinvent advertising by Tuesday, and no insistence that everyone else simply “didn’t get it.”

Instead, Viant spoke in complete sentences, with verbs that suggested experience rather than aspiration, and with a tone that implied its executives had actually been in rooms where budgets were cut, post-mortems were brutal, and explanations had to withstand more than polite nodding.

That tone mattered. In an industry where volume is often mistaken for conviction, Viant’s restraint read as credibility, and credibility travels far with buyers who have been over-promised into exhaustion.

I’ll say this plainly: I enjoy talking with Viant executives, at least those who still talk to me, because they are smart. They understand the market they’re operating in, they understand the constraints they face, and they rarely confuse elegance of theory with inevitability of outcome. There’s a quiet confidence there, the kind that comes from knowing you’re often among the smarter people in the room without needing to announce it.

The Anti-Hype Story Buyers Wanted to Believe

Viant’s story worked precisely because it never tried to dazzle.

What it offered instead was something more radical and, frankly, more appealing to weary buyers: fewer moving parts and fewer hands skimming value along the way. Less bloat. More transparency. Automation that reduced friction instead of adding new fees wrapped in new vocabulary.

This wasn’t a declaration of war on adtech so much as a clean-up pitch, delivered by people who sounded like they had actually held the mop before. Viant framed itself as a DSP for buyers tired of platforms that somehow became more complicated every year while delivering results that required increasingly creative explanations. It promised relief without revelation, efficiency without cosplay, and it treated skepticism as a sign of intelligence rather than resistance.

When Viant tells this story to ADOTAT, it holds together. The narrative is internally coherent, calmly argued, and delivered by people who have lived through enough “new eras” to know how quickly those banners tend to fade. That coherence matters, because buyers no longer reward optimism for its own sake. They reward stories that survive contact with spreadsheets.

Adelphic and the Seriousness of Intent

Viant has also been unusually clear about where its center of gravity lives.

Adelphic was never presented as a vanity DSP or a side project. Tim Vanderhook has consistently described it plainly as “our primary product, the demand-side platform,” which is executive shorthand for we are not hiding the real business somewhere else. Adelphic’s origins in mobile and in-app environments weren’t an accident, nor were they a liability. They were an early recognition that identifiers were already cracking and that pretending otherwise was not a viable strategy.

Since acquiring Adelphic, Vanderhook has been explicit that the goal was to move away from cookies and digital identifiers altogether, and to replace them with people-based data as infrastructure rather than marketing garnish. That belief becomes clearest in Viant’s approach to connected television.

Vanderhook often points out that while the ad appears on the television screen, the action usually happens somewhere else, noting that consumers reach for a second device roughly 60 percent of the time. That gap between exposure and action isn’t an edge case. It is the defining feature of CTV. Viant’s answer, the Household ID, was designed to unify televisions, smartphones, laptops, and other household devices into a single measurement construct so that outcomes could be attributed back to exposure without inventing a fairy tale in between.

Read honestly, this isn’t magical thinking. It is simply how people behave.

Where the Narrative Meets Physics

This is where the story starts to strain, not because the logic is wrong, but because the market has become less forgiving.

As Dan Levin of ViralGains put it to me, without dismissing the intelligence behind the strategy, Viant didn’t win by revolutionizing the DSP. It survived by pivoting to utility. In Levin’s framing, Direct Access isn’t a philosophical breakthrough so much as a practical one: a commercial lease on SpringServe infrastructure that helps publishers bypass SSP fees and reduce the so-called tech tax.

That move was smart, and it bought Viant real relevance. But it also subtly redefined Viant’s role in the ecosystem. As Levin said bluntly, “It’s essentially plumbing at this point.” Useful plumbing, thoughtful plumbing, but plumbing nonetheless.

Hard-coding Household ID into the supply path to reduce compute cost is similarly smart, but as Levin notes, it also becomes a race to the bottom on margin. In CTV, margins aren’t theoretical. They determine who gets preferred access and who clears what’s left.

Why CTV Is No Longer Rewarding Good Stories

Connected television in 2025 does not reward coherence alone. It rewards leverage.

When companies like Disney and Paramount restrict or tier DSP access, the motivation isn’t ideological. It’s economic. Shipping billions of bid requests to DSPs that transact at fractions of a percent is no longer tolerable when cloud bills are real and yield pressure is constant. A DSP that listens a lot but buys very little becomes, in Levin’s words, a financial liability to the publisher.

Access doesn’t disappear with a rejection letter. It disappears quietly, through algorithmic traffic shaping. DSPs still “have access,” but not to the moments that matter most: live sports, tentpole programming, and high-attention inventory. They end up clearing what remains.

Where Viant Actually Delivers Today

In practice, Viant’s scalable CTV delivery still tends to concentrate in inventory that clears after higher-priority commitments. Open-exchange CTV, long-tail FAST channels, ambient placements like screensavers, mid-tier AVOD inventory, and non-living-room environments such as gyms, airports, and waiting rooms make up a meaningful share of its footprint.

All of this is legitimate. All of it counts as CTV. But it is not first-call inventory, and that gap between functional access and preferential access is where the illusion begins to form.

A Smart Company at a Real Inflection Point

Here’s the hopeful part, and it matters.

Viant is not collapsing. It is not confused. And it is certainly not staffed by people who don’t understand the game they’re playing. It is navigating a CTV market that has made a deliberate decision not to recreate the open-web free-for-all on the most valuable screen in the house.

Direct Access is a step up the hierarchy. It is not the top of it. The vision still holds, and the people still hold, but the next phase requires shifting focus from proving how clean the pipes are to proving why the pipes are unavoidable.

That shift is about leverage, not logic. About demand gravity, not architectural elegance. And Viant, for all the smart things it has already done, is now standing at the point where understanding that difference becomes the work.

Stay Bold, Stay Curious, and Know More than You Did Yesterday

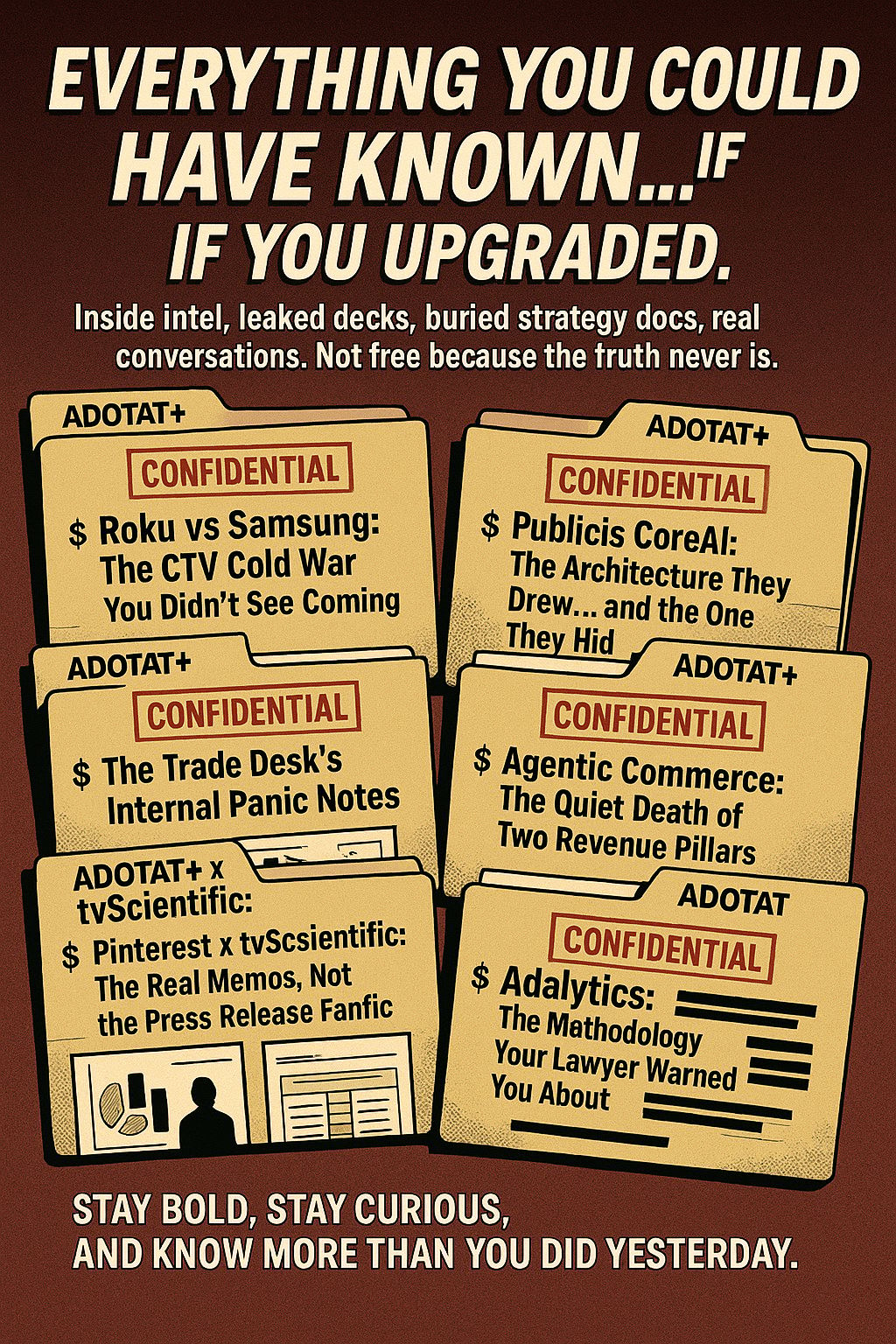

Turns out the internet has two kinds of people:

the ones who think they know what’s happening in advertising, marketing and adtech…and the ones who actually read ADOTAT+.

You just read the polite version.

The ADOTAT+ side is where this stops being biography and starts being power analysis. The parts you didn’t see are the uncomfortable ones: how patent enforcement quietly slows roadmaps, why Snowflake wasn’t a partnership but a positional coup, which platforms paid quickly and which blinked late, and how identity moved from “vendor feature” to de facto governance layer.

Free readers get the story arc.

ADOTAT+ readers get the leverage map.

If you want to understand how identity stopped being plumbing and started being rent, that’s behind the paywall.

Stay Bold, Stay Curious, and Know More than You Did Yesterday.

Subscribe to our premium content at ADOTAT+ to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

Upgrade