Seven Parts. One Industry Meltdown. Zero Chance Anyone’s Telling the Truth.

This Week on ADOTAT: Did I Learn Anything? My Wife Would Say No.

We’re trying something different: one storyline, seven chapters, a whole lot of ad-tech delusion.

Did I learn anything?

Maybe. Mostly that everyone is lying to themselves. Well not, everyone, but you gotta read on to actually know what I am talking about, right?

Part I: Amazon Shows Up in a Ferrari and The Trade Desk Has Feelings

Amazon doesn’t “enter” a market, more like it materializes like a boss battle. (Yeah, you get my video game reference?) Their new loyalty pact with Omnicom wasn’t subtle. The minute that deal dropped, the back-channel chatter started: big ad dollars are shifting. Not nickels. Not “test budgets.” Actual money.

Industry analysts, who track DSP bidding patterns like it’s a volatile crypto chart, started seeing double-digit percentage moves away from The Trade Desk and toward Amazon DSP in Q3.

And The Trade Desk?

They’re publicly insisting nothing’s happening while privately staring into the middle distance.

Jeff Green even said Amazon “doesn’t really have a DSP,” which is objectively hilarious given Amazon is charging 0% on owned inventory and 1% on open web.

If that’s “not a DSP,” then TikTok is “not social media.”

The subtext is simple:

Omnicom now controls Amazon’s U.S. marketing account.

Of course they’re shifting spend.

Part II: The SSPs Throw a Collective Tantrum and Hope No One Notices

Magnite, PubMatic, and Nexxen have been wandering earnings season like they’re stuck in a soap opera monologue. All three blamed their Q3 pain on “mysterious DSP behavior.”

Translation:

The Trade Desk pulled spend and didn’t bother sending flowers.

Inside the pipes, buyers are increasingly defaulted into OpenPath, TTD’s attempt to route inventory directly and skip SSP fees. SSPs call this predatory. TTD calls it efficiency. The truth?

It’s a slow-motion supply-chain takeover, and the SSPs are watching their margins disintegrate in real time.

Now every SSP is aggressively rebranding away from the word “reseller” like it’s a contagious disease. Even though, let’s be honest, half their supply paths look like a genealogy chart drawn during a migraine.

This is not a knife fight.

This is a knife-empathy-threat-therapy-session-fight.

Part III: Google Builds a Privacy Kill Switch Nobody Asked For

Google unveiled its new “RTB Control” feature: a button that allows any Google account holder to erase personal data from all programmatic bid requests.

The catch?

Users must:

Find the setting

Understand the setting

Toggle the setting

Which means maybe seven humans will ever use it.

Privacy advocates are cheering like someone released a rare bird back into the wild.

Ad-tech execs are shrugging because 2026 might as well be the year 3000.

When your Q3 revenue is underwater, worrying about hypothetical future privacy toggles is like giving a building a new fire escape while the lobby is actively on fire.

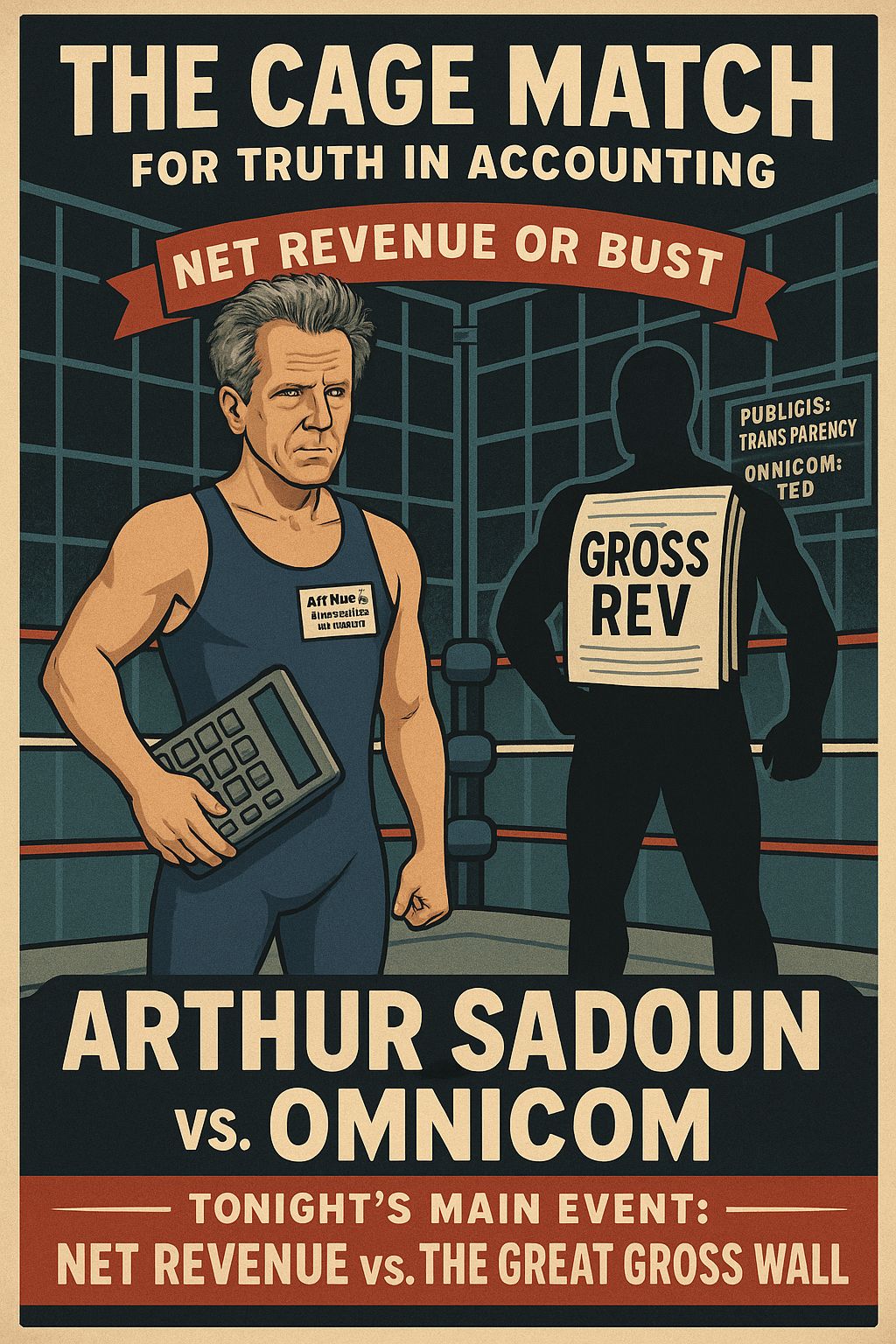

Part IV: Publicis Calls Out Omnicom’s Accounting Gymnastics With Professional Precision

Arthur Sadoun had the kind of quarter where you either take up meditation or you start swinging. He chose swinging.

His message was clear:

“Report net revenue like the rest of us. Or we’ll lower ourselves to your accounting style and see whose investors panic first.”

Omnicom, the company which just swallowed IPG in a megamerger — still refuses to report net revenue, relying instead on “gross revenue,” which obscures the actual margin story.

This is not a small debate.

This is a battle for financial credibility in a sector exhausted by AI hype, margin compression, and CFOs begging investors for patience.

Sadoun threw down the gauntlet.

Omnicom has responded with…

silence louder than a ringing fire alarm.

Part V: Agentio Gets $40M and Acts Like Creator Deals Are Just Another Sorta Supply Chain

Agentio raised $40 million to automate brand-creator matchmaking.

Their pitch:

“Creators are chaotic, negotiations are inefficient, let’s make this programmatic.”

If they’re right, they’ll shave off weeks of back-and-forth and displace legacy influencers-as-middlemen shops.

But here’s the problem:

Creators are not ad slots.

They are mood-driven humans who melt down over tone changes in email subject lines. Automating their partnerships is brilliant in theory and a potential operational wildfire in practice.

If Agentio pulls it off, they’ll break an entire industry tier.

If not, they’ll build the world’s most expensive personality-matching Roomba.

Part VI: Ad-Tech M&A Is a Bloodbath Wearing AI Lipstick

Q3 saw a 118% surge in M&A across the sector. Not because innovation is flourishing but because everyone is panicking about their ability to reach profitability.

Highlights:

Omnicom’s $13.25B IPG merger

Outbrain acquiring Teads for $900M

CloudX buying a mobile SDK player for $30M

All of this is being marketed as “synergy.” It’s not synergy.

It’s defensive consolidation under the smokescreen of AI narratives.

The connective tissue:

AI hype is inflating valuations and distracting everyone from the painful truth that scaling profitably is becoming impossible.

If you’re not buying someone, you’re being circled.

Part VII: Rokt Hits $1B and Wants to Be the One Sane Company in 2026

Rokt crossed $1 billion in annual revenue, which in this economy is basically walking on water. They’re now prepping for a 2026 IPO with Morgan Stanley whispering sweet nothings in their inbox.

Their pitch works because it’s clean and direct:

ecommerce-focused, measurable, and not dependent on the disastrous open-web ad circus.

If they go public before the rest of the sector finishes imploding, they might actually reset expectations for what a modern ad-tech business should look like.

Or, at minimum, they’ll give 2026 investors something to cling to when the next DSP or SSP writes its “challenging market conditions” earnings letter.

The CEO Calling BS on an Entire Reporting Strategy

Publicis vs. Omnicom: The Transparency Cage Match Nobody Asked For, but Everyone’s Watching

Publicis CEO Arthur Sadoun didn’t just “raise a concern.” He walked onto the global stage, pointed directly at Omnicom’s financials, and basically said: “Stop pretending gross revenue is anything but makeup on a tired balance sheet.”

Omnicom, still sweaty from swallowing IPG in its biggest gulp yet, is insisting that investors should keep squinting at its numbers like they’re one of those magic-eye posters from the 90s.

Sadoun’s response: absolutely not.

Why Sadoun’s Firing This Shot Now

Sadoun’s critique isn’t some technical footnote buried in an earnings call. It’s a line drawn in neon paint:

Publicis, WPP, everyone else: reports net revenue.

Omnicom: reports gross revenue, shrugs, and hopes nobody asks why.

And after acquiring IPG, Omnicom now sets the tone for the entire industry’s financial comparability.

If they stick with gross-only reporting?

Sector-wide fog machine.

Nobody can benchmark anything.

Margins look like they’re doing fine even when they’re wheezing.

Sadoun even threatened to “dumb down” Publicis’ reporting if Omnicom won’t grow up. You know it’s getting spicy when CEOs start threatening to become less transparent out of spite.

What’s Actually at Stake (Hint: It’s Not Just Accounting)

1. Investor Confidence Is Hanging by a Thread

Everyone’s already side-eyeing “AI-driven growth” like a diet supplement sold at a gas station.

Now you’re telling them the sector leader won’t report net revenue?

Great. Exactly what jittery investors needed: more guesswork.

2. M&A Fallout Is About to Get Real Messy

Omnicom just absorbed a major competitor. If they don’t offer net numbers, regulators and analysts are effectively trying to do surgery with oven mitts.

You can’t judge concentration risk if the reporting is mud.

3. Industry Credibility Is Already on Life Support

Clients are wondering why holding companies still exist in the age of automation and AI.

Now we add opaque reporting to the list of mysteries?

Stunning strategy.

Why This Moment Feels Different

The market is exhausted. Regulators are restless. Boards are allergic to surprises.

And Sadoun sees the opening:

If Publicis plants the transparency flag, it forces Omnicom to choose competence or clownery in full view of investors.

Omnicom’s counter-strategy so far:

Silence.

A bold choice for a multibillion-dollar organization that just absorbed another multibillion-dollar organization.

What Happens If Omnicom “Wins” This Fight

The industry reverts to gross-only reporting like it’s 2004 again.

Clients lose visibility into what agencies make vs. what they simply pass through.

Auditors get migraines.

Regulators get curious.

Independents get a flood of new business from brands tired of guessing what they’re paying for.

Sadoun knows this.

Everyone knows this.

Which is why this isn’t just sniping.

It’s a referendum on whether holding companies want to be treated like real businesses or continue cosplaying as tech companies with “adjusted everything.”

The Real Translation of Sadoun’s Message

“If Omnicom can get away with financial opacity, the entire industry backslides—and we’re not playing in that sandbox.”

He’s daring Omnicom to meet the standard or admit, publicly, that gross revenue is the last fig leaf covering margin compression, in-housing pressure, and the uncomfortable truth about actual organic growth.

And honestly?

It’s the most entertaining accounting drama you’ll see all year.

Subscribe to ADOTAT+ to read the rest.

Unlock the full ADOTAT+ experience—access exclusive content, hand-picked daily stats, expert insights, and private interviews that break it all down. This isn’t just a newsletter; it’s your edge in staying ahead.

Upgrade