Modernize your marketing with AdQuick

AdQuick unlocks the benefits of Out Of Home (OOH) advertising in a way no one else has. Approaching the problem with eyes to performance, created for marketers with the engineering excellence you’ve come to expect for the internet.

Marketers agree OOH is one of the best ways for building brand awareness, reaching new customers, and reinforcing your brand message. It’s just been difficult to scale. But with AdQuick, you can easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

Sign up here |

|

|---|

The Apology Didn’t Die. It Just Quietly Packed Up Its Desk.

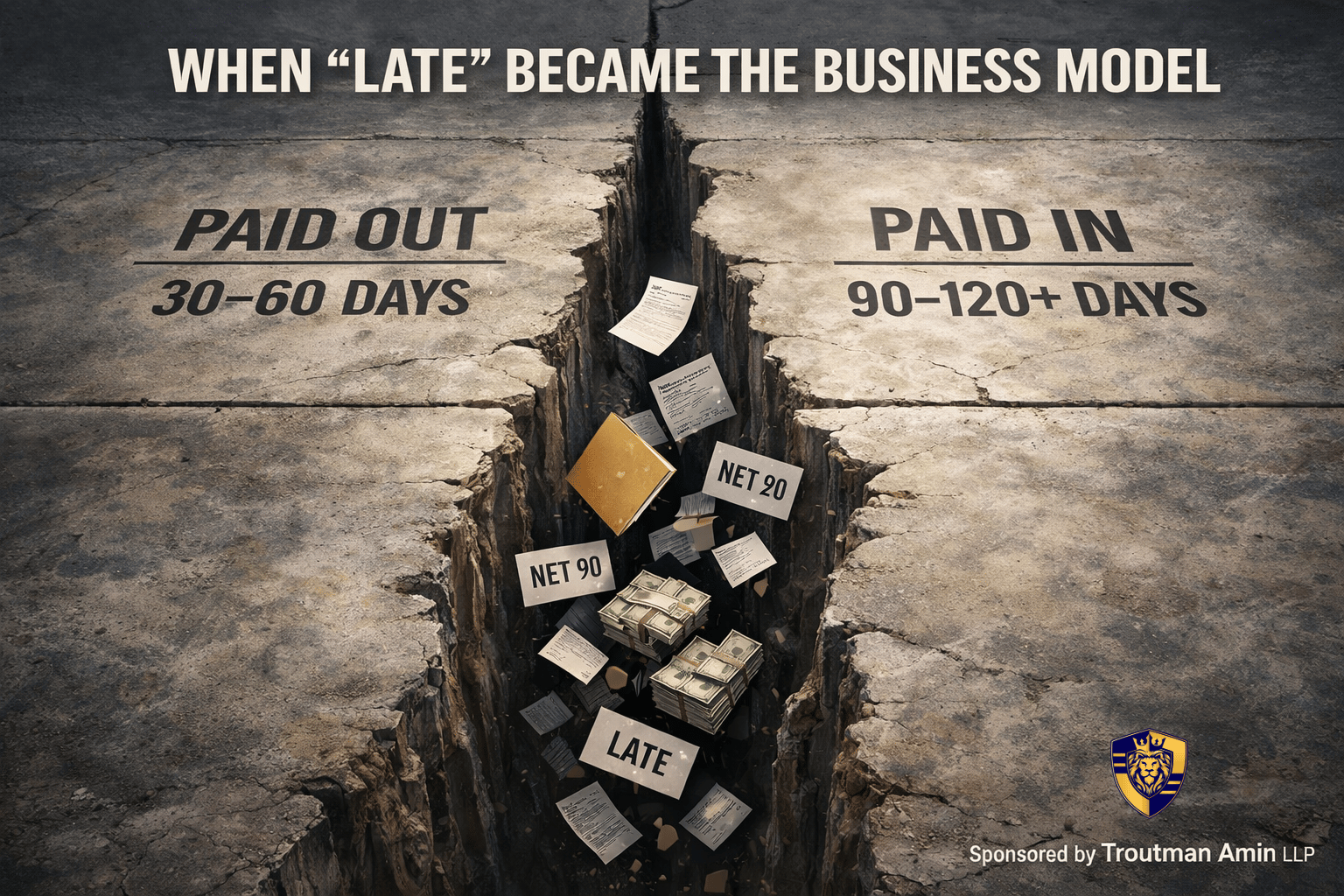

When “Late” Became the Business Model

There used to be a recognizable choreography to a late payment in advertising.

An email would land with a careful subject line, apologetic but noncommittal. A finance lead would mention a system upgrade, a reorg, a missing approval that somehow wandered into a corporate corn maze and never found its way out. The details varied. The tone didn’t.

This was an exception.

Please don’t read into it.

We’re adults here.

That choreography is gone.

By the end of 2025, late payments stopped behaving like an accident and started behaving like architecture. Not a malfunction. Not a temporary snag. A structural feature.

Scott Ryan, CEO of TVIq, put it plainly: Net 60 operates like Net 120 in many cases, not because contracts were rewritten, but because behavior was.

Once lateness becomes predictable, it stops being a failure of the system and starts being the system.

And once that happens, alarm fades.

What used to feel like friction dissolves into background noise, like the low buzz of a fluorescent light everyone pretends not to hear until it flickers and dies.

The Data Finally Took Off the Kid Gloves

According to OAREX, roughly 58% of digital media payments arrived late in the first half of 2025. That’s the worst figure they’ve ever reported. On its own, that should make anyone with a balance sheet sit up straighter.

But the headline number is polite compared to what’s underneath it.

This isn’t about invoices drifting a day or two past terms, the kind of delay that can be smoothed over with a friendly nudge and a shared calendar invite.

Payments are not just late.

They are later.

The tail is getting longer. The bucket marked very late is filling faster than the one marked simply late. That’s the difference between friction and fracture. One is annoying. The other eventually breaks things.

And crucially, this does not look cyclical.

Oliver Gwynne was explicit on that point. Cycles snap back. This doesn’t. What’s happening feels more like a quiet rewrite of operating assumptions everyone has been pretending still hold.

The danger is subtle but profound. Once lateness is predictable, it stops functioning as a warning sign and starts functioning as infrastructure.

What makes this more than a bad quarter is that OAREX doesn’t see this as a peak. Based on what’s already flowing through the system, they expect late payments to climb again in 2026. Not flatten. Not self-correct. Worsen.

Across OAREX, PYMNTS, and other payment-tracking sources touching media and adjacent digital services, the signals line up with eerie consistency.

Payments are slower.

Variability is higher.

Reconciliation windows are stretching like old elastic.

The industry isn’t fixing the pipes.

It’s putting down buckets and calling it resilience.

When Even the Infrastructure Starts Whispering Warnings

One of the clearest signs that something has shifted is how the platforms themselves are behaving.

Late in 2025, PubMatic began providing publishers with visibility into buyer payment patterns through what it calls the Buyer Signal Report. This wasn’t rolled out as thought leadership or a shiny monetizable insight product.

It followed direct publisher feedback after industry disruptions, including the MediaMath bankruptcy.

That timing matters.

Officially, PubMatic is careful. The report is not a credit rating. Not a solvency judgment. Not a prediction of failure. The Green, Yellow, Red framework is positioned as a planning and transparency tool, designed to help publishers anticipate cash-flow dynamics based on long-established operating patterns.

But the motivation is less academic than the framing suggests.

As Gwynne observed, when counterparties stop feeling reliably solvent in the normal course of business, payments stop being admin and start being risk signals. In that light, surfacing buyer stress isn’t innovation. It’s self-defence.

Scott Ryan was more skeptical about intent, saying he was unsure, but that it felt like pressure. Naming and shaming, or at least naming and signaling, the buyers creating downstream cash-flow issues.

Whether defensive or coercive, the existence of the report itself signals the same thing.

Ambient trust has cracked.

Ten years ago, the idea that an SSP would issue a recurring, color-coded report to help publishers plan around payment timing would have sounded absurd.

Today, it sounds prudent.

When an SSP formalizes payment behavior into recurring infrastructure, that isn’t innovation.

It’s triage.

What “Yellow” Actually Means

Strip away the branding and the framework reads less like adtech jargon and more like a credit committee checklist:

How often does a buyer miss terms?

How predictable is their payment timing?

How many months of invoices remain open?

How much effort does collection require?

Do other public signals suggest elevated risk?

Yellow does not mean insolvency. It reflects deviation from ideal timing, not imminent collapse. Directional context, not a warning flare.

But the important point isn’t who is yellow.

It’s that payment behavior is now treated as an operational variable, not an administrative footnote.

That alone tells you something fundamental has changed.

From Mild Annoyance to Structural Risk

For years, advertising treated payment friction the way cities treat traffic. Inconvenient. Inevitable. Annoying. Manageable if you leave early and keep your coffee warm.

Media is complex. Campaigns move fast. Money moves slow. Everyone waits on someone else. As long as growth flowed and capital was cheap, the gaps could be bridged with credit lines and confidence.

Payment delays were irritating, but survivable.

That story stopped working in 2025.

Longer stated terms collided with chronic lateness and tighter credit conditions, stretching the distance between paying out and getting paid beyond what operating leverage can quietly absorb.

Gwynne drew the line clearly. Routine lateness becomes a solvency issue the moment it’s normalized internally, when finance teams stop escalating it, when ops teams plan around it, when forecasts quietly assume it.

At that point, you’re no longer managing cash flow.

You’re underwriting someone else’s balance sheet.

And the problem isn’t theoretical anymore.

Ryan noted that it already has, and it’s getting worse, particularly in CTV. As more publishers buy back or extend their own inventory, they’re being pushed into carrying a float against TAC, a role they never priced for and never wanted.

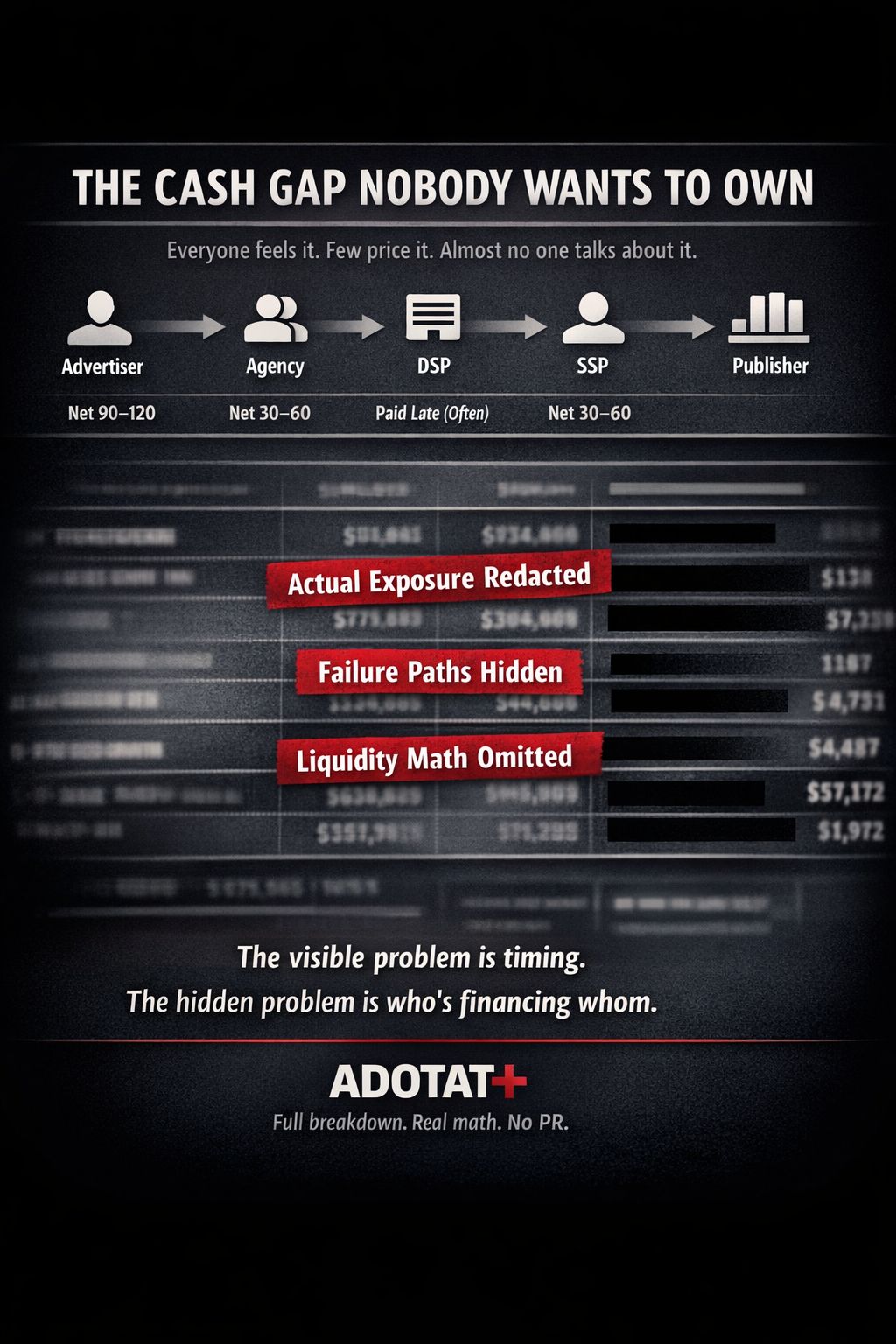

Who’s Actually Financing the System

This is the part people don’t like, because it forces uncomfortable math.

In theory, DSPs sit in the middle.

In practice, SSPs and marketplaces are financing the system.

“You might not like my answer,” Ryan said, but in his view it’s SSPs and marketplaces carrying the weight, because payment terms are tighter downstream than what agencies are held to upstream.

Gwynne arrived at the same conclusion from a different angle, describing it as vendor financing dressed up as partnership. Cheap credit. Compulsory credit.

Cash leaves on one clock.

Cash returns on another.

The difference doesn’t disappear. It accumulates. Month after month.

The damage doesn’t show up in press releases or earnings calls. It shows up internally. In payment queues. In reprioritization. In who gets paid this week and who gets a polite promise.

The Smoke Smells Familiar Because It Is

If this feels familiar, it should.

MediaMath wasn’t a one-off. It was a dress rehearsal.

The collapse didn’t begin with bankruptcy filings. It began earlier, when payment behavior quietly changed and everyone convinced themselves it was temporary.

Late payments stopped being a stress signal and became a survival tactic.

As long as the music played, no one wanted to talk about cash.

By the end of 2025, the music slowed.

This used to be an accounting problem.

In 2026, it’s a solvency test.

Stay Bold, Stay Curious, and Know More than You Did Yesterday.

The Rabbi of ROAS

PubMatic didn’t write a think piece.

They built a report.

A monthly view into who pays late, how late, and how consistently, framed as planning and transparency but quietly doing something more important: making chronic lateness visible.

That shift matters. When payment behavior needs a dashboard, trust has already cracked.

If you want to see what the Buyer Signal Report actually looks like and why publishers asked for it in the first place, it’s in the paid section.

No hype. No accusations. Just infrastructure telling the truth.

What You’re Missing in ADOTAT+

The Part Everyone Pretends They Didn’t Read

You just read the public version. The part that’s safe enough to circulate, alarming enough to nod along to, and vague enough that nobody has to admit whether they’re exposed.

ADOTAT+ is where the math stops being abstract and starts pointing fingers.

Behind the paywall, we do the things polite industry writing avoids:

We run the numbers. Real cash-gap math at real spend levels, not “illustrative examples” that magically stay small.

We map the blast radius. Exactly where risk actually sits today, who’s quietly carrying it, and who’s already offloading it onto someone weaker.

We translate the legal fiction. Sequential liability, clawbacks, conditional payment language. Not as contracts, but as incentives and failure paths.

We show you the tells. Which behaviors signal stress months before a headline ever appears. Who tightens terms. Who stretches them. Who suddenly needs “one small favor.”

We name the asymmetry. Why cash-rich platforms are winning without shipping better tech, and why independents keep mistaking growth for safety.

Most industry coverage stops at “this seems unsustainable.”

ADOTAT+ answers the uncomfortable follow-up: unsustainable for whom.

If you’re a DSP, SSP, publisher, agency operator, or investor and you’re still thinking this is a finance-team issue, the paid side is where that illusion dies. Quietly. With spreadsheets.

Subscribe to our premium content at ADOTAT+ to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content.

Upgrade